價格:免費

更新日期:2020-04-16

檔案大小:17.7 MB

目前版本:6.0

版本需求:系統需求:iOS 11.0 或以後版本。相容裝置:iPhone、iPad、iPod touch。

支援語言:英語

The financial calculator is an app that is used to calculate various financial calculations using various Government Schemes of India.

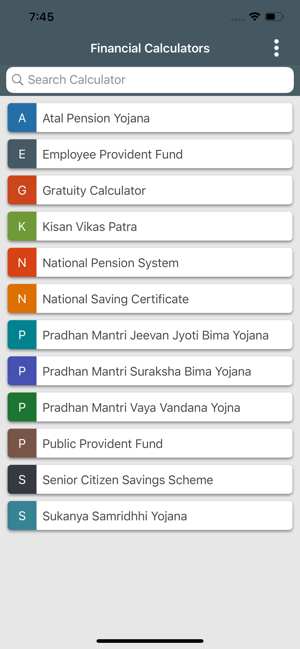

Some of the key calculations of the app are:

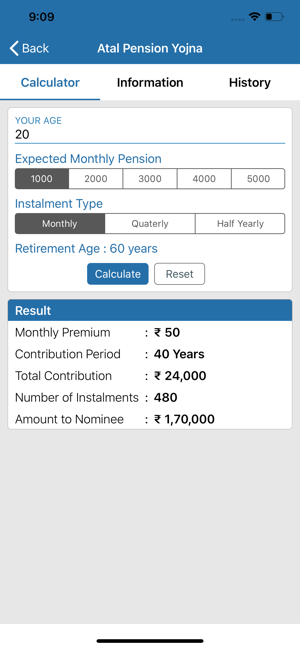

1) Atal Pension Yojana (APY) / Atal Pension Scheme (APS) Calculator - It is a government-backed pension scheme in India. It provides guaranteed pension ranging from Rs.1000 to Rs. 5000 per month. It is administered by the PFRDA.

2) Gratuity Calculator - Gratuity is the amount of money which an employer pays to his employee in return for services offered by him to the company. Only those employees who have been employed in the company for five years or more than five years are given a gratuity.

3) Kisan Vikas Patra - Kisan Vikas Patra is a saving certificate scheme which was first launched in 1988 by India Post.

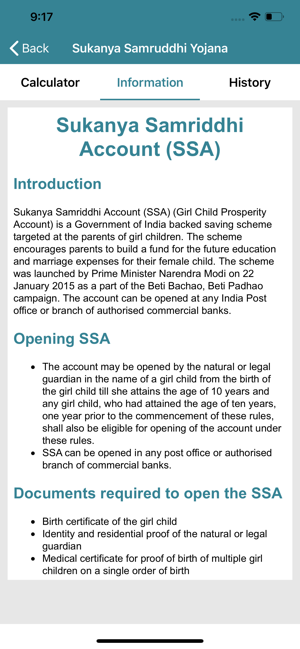

4) National Saving Certificate - National Savings Certificates, popularly known as NSC, is an Indian Government Savings Bond, primarily used for small savings and income tax saving investments in India. It is part of the postal savings system of Indian Postal Service.5)Sukanya Samridhhi Yojana - Sukanya Samriddhi Yojana (Girl Child Prosperity Account) is a Government of India backed saving scheme targeted at the parents of girl children. The scheme encourages parents to build a fund for the future education and marriage expenses for their female child.

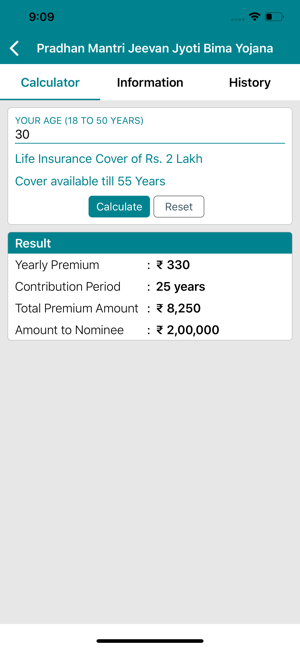

6) Pradhan Mantri Jeevan Jyoti Bima Yojana - Pradhan Mantri Jeevan Jyoti Bima Yojana is a government-backed Life insurance scheme in India.

7) Pradhan Mantri Suraksha Bima Yojana - Pradhan Mantri Suraksha Bima Yojana is a government-backed accident insurance scheme in India.

8) Pradhan Mantri Vaya Vandana Yojna - Pradhan Mantri Vaya Vandana Yojana (PMVVY) is a Pension Scheme announced by the Government of India exclusively for the senior citizens aged 60 years and above.

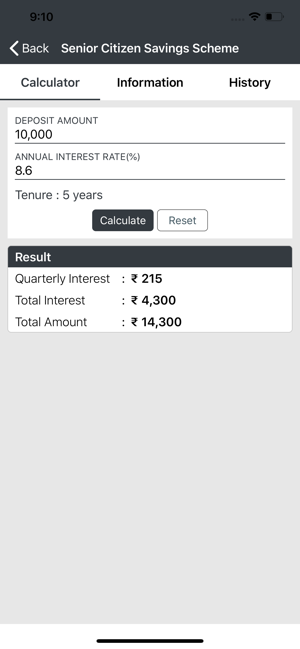

9) Senior Citizen Savings Scheme - The Senior Citizens Savings Scheme (SCSS) is primarily for the senior citizens of India. The scheme offers a regular stream of income with the highest of safety and tax saving benefits. It is an apt choice of investment for those over 60 years of age.

10) Employee Provident Fund - Employee’s Provident Fund (EPF) is a retirement benefit scheme that’s available to all salaried employees. This fund is maintained and overseen by the Employees Provident Fund Organisation of India (EPFO) and any company with over 20 employees is required by law to register with the EPFO.

11) Public Provident Fund - The PPF was first offered to the public in the year 1968 by the Finance Ministry’s National Savings Institute. Investors use the PPF as a tool to build a corpus for their retirement by putting aside sums of money regularly, over long periods of time.

12) National Pension System - It is a pension cum investment scheme launched by Government of India to provide old age security to Citizens of India. It brings an attractive long term saving avenue to effectively plan your retirement through safe and regulated market-based return.

Key features of the app include:

- It is a free app

- Simple and easy to use UI

- It does not require internet to do the calculations.

-----------------------------------------------------------------------------------------------------------------

This App is developed at ASWDC by Prof. Hardik Doshi. ASWDC is Apps, Software, and Website Development Center @ Darshan Institute of Engineering & Technology, Rajkot run by Students & Staff of Computer Engineering Department

Call us: +91 97277 47317

Write to us: aswdc@darshan.ac.in

Visit: http://www.aswdc.in http://www.darshan.ac.in

Follow us on Facebook: https://www.facebook.com/DarshanInstitute.Official

Follows us on Twitter: https://twitter.com/darshan_inst